How to Save on Rental Cars

Rental cars can be a big expense on a vacation but there are ways to save big or get your rental car for free with credit card points! Keep reading below for some some ideas on how to to use credit card points to book your rental cars, how to save money when you pay cash for your rental car, and how to earn more points on a rental car purchase!

How to Use Credit Card Points and Miles for a Rental Car:

Disclaimer: Redeeming points and miles for rental cars is usually not the best way to get the biggest value out of your points, but if you value more cash in your pocket, free is free and this is a great option for you!

Here are two popular ways to use credit card points to cover the cost of a rental car:

Book your rental car in a bank’s travel portal! All major banks allow you to book a rental car in their portal with points.

Cover your travel expenses with Capital One Venture Miles! If you have Venture Miles earning credit card like a Capital One Venture Rewards Credit Card or a Capital One Venture X Rewards Credit Card, you can cover any travel expense you make on your card with your miles. For example, if you pay $300 for a rental car with your card, it will code as travel and you can cover that expense with 30k Venture Miles. See here for more information on how to cover your travel expenses with Venture Miles!

How to Save on Rental Cars:

4 popular ways save on rental cars:

Use AutoSlash! You can select all of the different hotel, airline, AARP, statuses and credit cards you have and they will search for the best possible rate for you based on that information.

Rent through Turo. Turo is like the AirBNB of rental cars that matches you with owners who rent their cars out for short term car rentals.

I have had good luck booking through Alamo or Costco Travel for competitive rates!

If you have a Capital One Venture X card, you are eligible for Hertz President’s Circle Status! Perks of this status include being able to skip the counter, guaranteed upgrades, and free additional drivers.

Saving on Rental Car Insurance

Tip: Pay for your rental car with a credit card that covers primary rental car insurance!

There are two main types of credit card rental insurance: primary and secondary. With primary rental car insurance, you can file a claim first with your credit card car rental insurance. With secondary car rental insurance, you must first file a claim with your own auto, home or renter's insurer, and the credit card insurance may pick up extra costs not covered by your policy. My favorite credit cards that cover primary rental car insurance are the Chase Sapphire Preferred and the Capital One Venture X!

Note: Turo is typically NOT covered by credit card primary rental car insurance, so please be aware of this if you decide to go with Turo for your rental car.

Save More with Merchant Offers

Sometimes you can save on rental cars through merchant offers! Merchant offers are essentially coupons that different banks offer with your credit cards. You can find these from Chase, Citibank, Capital One, and American Express. They change regularly, vary in a specific amount of cash back verses a percentage of cash back, and they all have certain terms & conditions that need to be met in order to receive the cash back. One annoyance about these offers is that you DO need to add each of these offers to your specific credit card in each bank account - they are NOT automatically applied. These merchant offers change and vary often so I recommend checking the offers on your cards frequently.

Below is an example of a Turo offer from Chase:

These Chase offers can be found on the home screen of your Chase banking website. This offer was available on my Chase Freedom Flex® card. It is important to note that there will be different offers for each card you hold. If you have multiple cards with the same bank, some offers may overlap and be available on multiple cards.

When you click on the specific offer, you will be able to add it to your card, see when the offer expires (February 9th, 2025), as well as the terms & conditions of how much you need to spend in order to receive the offer. This offer was $30 cash back when you spend $150 or more.

While this is not a Turo purchase, this an example of the e-mail you will receive after redeeming a Chase merchant offer.

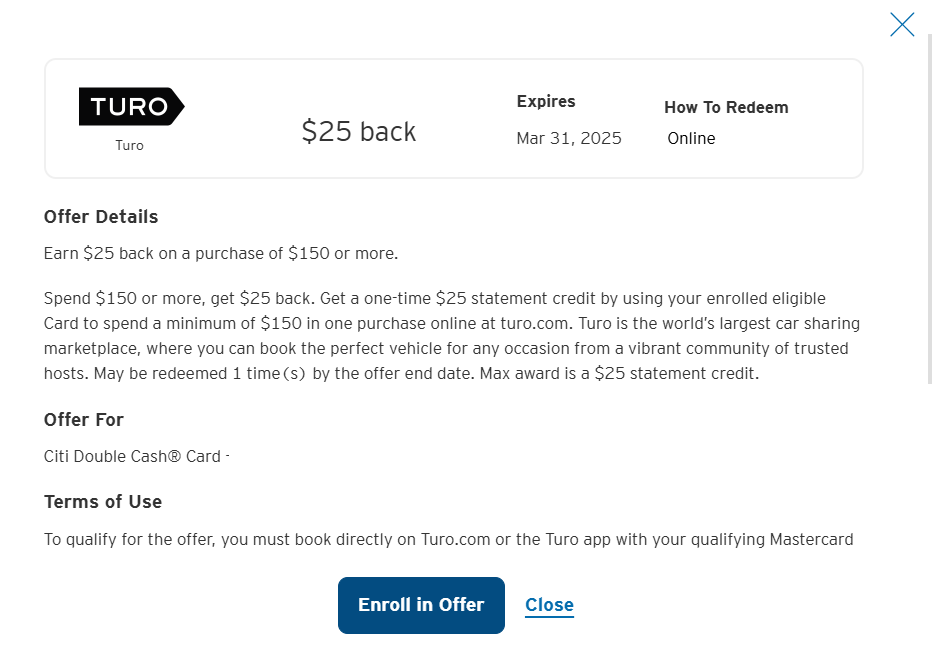

Below is an example of a Turo offer through Citibank.

This offer was $25 cash back one-time on a purchase of $150 or more.

Remember these offers vary by card, they are not always available, and they have specific terms and conditions you must follow in order to receive the cash back. I think it’s always worth it to check!

Maximizing Your Points When Renting a Car

If you don’t use your credit card points to cover the cost of a rental car, here are some ways EARN quite a few points on your rental car booking :

Earn 10x miles on car rentals booked through Capital One Travel if you use your Capital One Venture X card. (This card also has good primary rental car insurance!)

Earn 8x points on car rentals booked through Chase Travel if you use your Chase Sapphire Reserve® credit card, which also has great rental car insurance.

Earn 10x ThankYou points on car rentals booked through the Citi Travel portal if you have the Citi Prestige Card (no longer available for signups) or the Citi Strata Premier Card.

Using a shopping portal like Rakuten or American Airlines Shopping Portal PLUS using a card that has a higher multiplier on Travel and Rental Car transactions. All of the following cards earn at LEAST 2x points on every dollar you spend on rental cars:

Chase Sapphire Preferred - 2x Chase Ultimate Rewards points earn on all travel purchases, in addition to primary insurance on theft or collision damage in most countries, and this covers rental periods up to 31 consecutive days.

Capital One Venture X - 2x Capital One Miles earned on each dollar spent on all purchases. This card comes with auto rental collision damage waiver, you can use your annual $300 travel credit to book rental cars through Capital One Travel, and it also includes Hertz President’s Circle status.

Ink Business Preferred® Credit Card - 3x Chase Ultimate Rewards points earn on all travel purchases if you are renting a car for business. This card comes with primary car rental coverage for business rentals domestically and internationally, and secondary auto coverage for personal rentals inside the U.S., but primary outside the U.S.

Booking Through a Shopping Portal

Stack your point earnings on a rental car purchases is to go through a shopping portal to make your booking. You can see much more details about utilizing shopping portals in this post here.

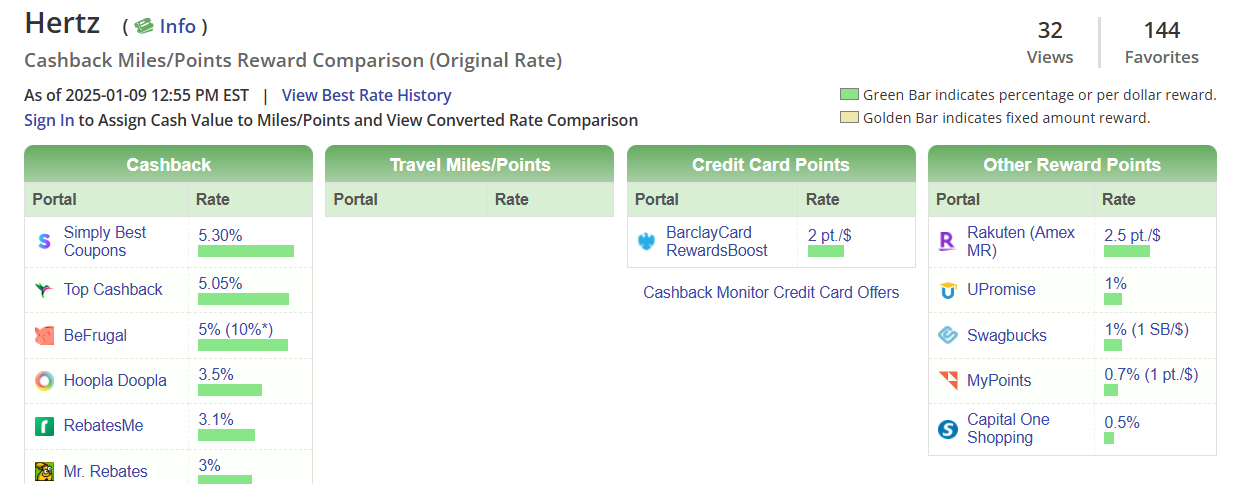

A shopping portal will help you earn an additional cash back or points on many online purchases you make, and sometimes include rental cars. Utilizing Cashback Monitor can be a great way to see where you can earn the most points or cash back on any given day for many different websites. In this example below for Hertz.com, you can earn 2.5 American Express Membership Rewards points for each dollar you spend on Hertz.com.

Once you click through to a website like Rakuten, you will see the cash back terms & exclusions, as well as additional coupon codes that may be available for you. Note: Shopping portals may not give you cash back if you use a coupon code that was found from somewhere outside of their shopping portal.

Bottom Line

While I prefer to use my points and miles for hotels and flights, it is definitely possible to use credit card points for rental cars and there are definitely ways to save and earn more points on your purchase if you chose to pay cash for your rental car!

FREE Beginner’s Guide to Points and Miles

Want to travel for free?! ✈️ Grab a FREE Beginner's Guide to Points and Miles and learn how to redeem FREE TRAVEL this year! CLICK HERE TO DOWNLOAD.

When you apply for a credit card using my affiliate links I earn a commission. I always appreciate it when you support free content by using my affiliate links.

YOU MIGHT ALSO LIKE: