Bilt Card 2.0: How to Earn Points on Rent and Mortgage

Bilt just rolled out Bilt Card 2.0 (available on February 7th) — and while headlines focus on “earning points on rent and mortgages,” the truth is more nuanced. Bilt still lets you pay rent or mortgage with no transaction fees, but how you earn points on those housing payments now depends on the path you choose.

Before we get into the details, here’s the core takeaway:

👉 There are now two fee-free ways to earn points on rent and mortgage payments with Bilt Card 2.0:

A new tiered automatic points system based on everyday card spending

The original Bilt Cash unlock method that lets you activate up to 1x points using Bilt Cash earned on purchases

If you’re new to Bilt, it’s worth noting that:

You don’t need a Bilt credit card to earn Bilt Points. You can earn Bilt points through creating a free Bilt account and participating in their rewards program. You can learn how to earn Bilt points without a credit card in 4 simple steps -> HERE! )

You don’t necessarily have to earn Bilt points on your mortgage for a Bilt credit card to be worth a spot in your wallet. Bilt points are VALUABLE. See this post for a breakdown of the 3 new Bilt 2.0 cards!

Let’s break this down in plain English 😅

How Housing Payments Earn Points Under Bilt Card 2.0

With Bilt Card 2.0, paying your rent or mortgage still doesn’t cost a fee, and you can still earn valuable Bilt points — but how much you earn depends on which earning path you select each month.

Option 1: Tiered Automatic Points on Housing

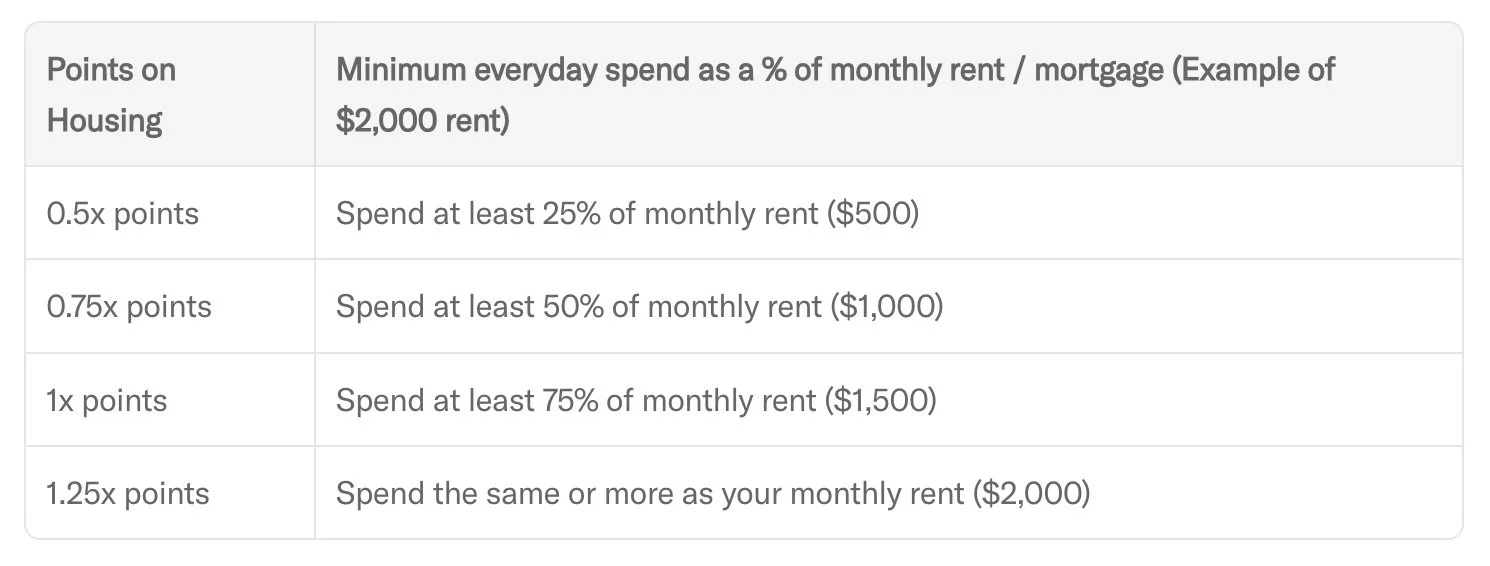

Bilt now offers a tiered fee-free earning option that automatically awards points on your housing payment based on how much everyday spending you put on your card in a billing period. This doesn’t require Bilt Cash or any extra steps — once you hit a spend tier, you earn a corresponding point rate each month.

Image via Bilt

If you don’t meet the minimum spending threshold, you’ll still earn a baseline 250 points per housing payment, just like the original program.

This option is great for readers who want simplicity — you don’t need to track Bilt Cash or activate anything manually: you just spend on the card, and Bilt automatically applies the right multiplier.

Option 2: Use Bilt Cash to Unlock Up to 1x Points on Housing

The original Bilt Card 2.0 model — earning Bilt Cash from everyday purchases and using it to unlock point earning on your rent or mortgage — still exists alongside the new tiered system.

Here’s how it works:

You earn 4% back in Bilt Cash on everyday spend with your Bilt card (excluding rent/mortgage).

You can then apply that Bilt Cash to “unlock” Bilt points on your housing payment — fee-free.

The common math rule of thumb: $30 in Bilt Cash unlocks 1,000 Bilt points on $1,000 of rent or mortgage.

That means you need roughly 3% of your housing payment in Bilt Cash to unlock 1x points on the full amount.

To generate that much Bilt Cash, most people would need to put roughly 75% of their rent or mortgage amount on non-housing spending on their Bilt card each month.

Example: $4,000 Rent Payment:

Let’s say:

Your monthly rent is $4,000

You’ve earned $60 in Bilt Cash from everyday spending

What happens?

You can still pay the full $4,000 through Bilt with no transaction fees.

Your $60 in Bilt Cash allows you to earn points on $2,000 of that rent payment:

$60 ÷ 3% = $2,000

The remaining $2,000 of your rent does not earn points.

That works out to 0.5 points per dollar across the full payment

Use the Calculator: Does the Bilt Cash Method Make Sense for You?

This calculator shows:

How much Bilt Cash you’d need to unlock points on your full rent or mortgage

How much non-housing card spend it would take to earn that Bilt Cash at a 4% rate

Enter your monthly rent or mortgage below to calculate:

Monthly housing payment (rent or mortgage) ($) — Calculate

This tool helps you answer key questions:

Is it realistic for you to earn enough Bilt Cash each month to earn 1 points per dollar on your housing expense??

Or would the tiered automatic points option make more sense?

Tip: If the calculator shows the required everyday spend is more than you already have on your card, the tiered automatic option may be a simpler and more realistic way to earn points on housing each month.

Spend Needed to Earn 1 Point per Dollar on Housing

Assumes you need ~3% of your housing payment in Bilt Cash to earn points on the full amount, and you earn Bilt Cash at ~4% on everyday card purchases. Always confirm final terms with Bilt.

Real-Life Example (For Both Options)

Let’s say your monthly housing payment is $1,800:

With the Bilt Cash method:

You’d need ~$54 in Bilt Cash to unlock 1x points on $1,800

At 4% Bilt Cash back, that requires ~$1,350 in non-housing spend (75% of $1,800) to generate that Bilt Cash

With the tiered automatic option:

If you spend ~$1,350 (75% of $1,800) in everyday purchases, you’d likely hit the 1x tier that month

Spend more and you could reach 1.25x points on your housing payment without needing to use any Bilt Cash

The Bottom Line

Is earning points on your rent/mortgage worth it?! It depends!

With the updated Bilt Card 2.0 system, you get two fee-free, flexible ways to earn points on rent and mortgage payments:

A simplified automatic tiered system based on how much everyday spend you put on your card

The classic Bilt Cash unlock method, which still exists and can be powerful if you spend heavily on regular purchases

I personally haven’t decided if it’s worth it to me yet as it requires a lot of spend on the card. However, the Palladium card that also earns 2x Bilt points on everyday purchases seems compelling to me as it’s similar to the Capital One Venture X Rewards Card that also earns 2x on all purchases, but I value earning Bilt points over Capital One miles.

However, the Bilt Palladium Card’s ability to earn 2× Bilt points on everyday purchases makes getting a Bilt card compelling to me. That’s similar to how the Capital One Venture X Rewards Card earns 2× on all purchases — except I personally value Bilt points more than Capital One miles, so the earning structure feels valuable for my travel and points earning goals.

Earning Bilt Points on your rent/mortgage works best if you:

Can put a meaningful amount of spend on the card

Like the idea of earning points on a bill that normally earns zero

Plan to transfer Bilt points to travel partners, where the value can exceed 1¢ per point

Related Posts:

Bilt Card 2.0: Full Breakdown of the New Card Lineup

FREE Beginner’s Guide to Points and Miles

Want to travel for free?! ✈️ Grab a FREE Beginner's Guide to Points and Miles and learn how to redeem FREE TRAVEL this year! CLICK HERE TO DOWNLOAD!

I appreciate it so much when you use my affiliate links that are linked in the post.

YOU MIGHT ALSO LIKE: