Bilt Card 2.0: Full Breakdown of the New Card Lineup

Bilt recently announced Bilt 2.0, expanding from a single credit card into a full lineup of cards at different price points for renters and homeowners. The new Bilt credit cards won’t be available for new cardholder applications until February 7th!

The Bilt cards are designed to layer on top of their rewards program by earning both Bilt Points and Bilt Cash on everyday spend — including the ability to earn Bilt points on rent and mortgage payments.

Below, I’ll walk through the Bilt Card 2.0 cards, who each one is best for, and how to decide which fits your spending style.

(If you’re new to Bilt, it’s worth noting that you don’t need a Bilt credit card to earn Bilt points. You can earn Bilt points through creating a free Bilt account and participating in their rewards program. You can learn how to earn Bilt points without a credit card in 4 simple steps -> HERE! )

What Changed With Bilt Card 2.0

The biggest shift with Bilt Card 2.0 is that earning points on housing — including mortgages, which are new with this update — is now tied to how much you use the card for everyday spending.

Instead of automatically earning points on rent or mortgage payments, Bilt introduced Bilt Cash. You earn Bilt Cash from everyday purchases, and that Bilt Cash is what unlocks the ability to earn points on rent or mortgage payments without transaction fees.

You’ll typically need to put about 75% of your rent or mortgage amount in non-housing spend on your card each month to be able to earn points on your full mortgage payment, fee free. (Keep reading for more details on how this works)

Bilt also expanded from one card to multiple options designed for different spending styles.

The New Bilt Card Lineup

Bilt Blue

Annual fee: $0

The Bilt Blue Card is the no-annual-fee entry point into the Bilt ecosystem.

Welcome offer:

Earn $100 in Bilt Cash when you apply and are approved

Everyday earning:

Earn 1 Bilt point per dollar on everyday purchases

Earn 4% Bilt Cash back

Bilt Obsidian Card

Annual fee: $95

The Bilt Obsidian Card is the mid-tier option in the Bilt Card 2.0 lineup and is designed for people who spend consistently on everyday categories like dining, groceries, and travel.

Welcome offer:

Earn $200 in Bilt Cash when you apply and are approved

Everyday earning:

Earn 3 Bilt points per dollar on dining or grocery purchases (up to $25,000 per year, category selection applies)

Earn 2 Bilt points per dollar on travel purchases

Earn 1 Bilt point per dollar on all other everyday spending

Earn 4% Bilt Cash back

Travel credit:

$100 annual Bilt Travel portal hotel credit

Issued as two $50 credits, available biannually per calendar year

Valid on eligible hotel bookings made through the Bilt Travel portal

Bilt Palladium Card

Annual fee: $495

The Bilt Palladium Card is the premium option in the Bilt Card 2.0 lineup and is built for spenders who want to consistently earn 2x points on all non housing costs.

Welcome offer:

Earn 50,000 Bilt points after spending $4,000 on purchases in the first three months

Earn Gold elite status after meeting the welcome offer spend requirement

Earn $300 in Bilt Cash after application approval

Everyday earning:

Earn unlimited 2 Bilt points per dollar on everyday spending

Earn 4% in Bilt Cash back

Travel credits & perks:

$400 annual Bilt Travel portal hotel credit

Issued as two $200 credits, available biannually

$200 in Bilt Cash annually, deposited each year

Priority Pass membership, providing access to participating airport lounges

Bilt Points vs Bilt Cash

Bilt Points are the travel-focused side of the program. These are the points you’d use if you want flexibility — transferring to airline and hotel partners at a 1:1 rate or redeeming for things like travel, rent-related credits, or statement credits. (I LOVE Bilt’s transfer partners - see more info on that here)

How to Earn Bilt Points:

Earn Bilt points through Bilt credit card spend.

Participate in Bilt’s reward program (no credit card required) Learn more about how to earn Bilt points without a Bilt credit card here.

Bilt Cash can be redeemed for select purchases made through Bilt, such as fitness bookings, hotels, food delivery, and rideshare.

You can also use Bilt Cash to activate point earning on mortgage and rent payments. When you apply Bilt Cash to rent or mortgage charges, you can earn up to 1x Bilt Points on those payments — something that wouldn’t otherwise earn rewards. (more on this below)

Bilt Cash isn’t designed to be hoarded long-term. Any unused balance typically resets at the end of the calendar year, though up to $100 can carry forward.

How to earn Bilt Cash:

Starting in 2026, you'll earn $50 of Bilt Cash for every 25,000 Bilt Points you earn toward your status across the Bilt ecosystem.

All Bilt 2.0 cardholders earn 4% Bilt Cash on every purchase.

How to Earn Fee-Free Points on Housing

One of the most important things to understand about Bilt Card 2.0 is how earning points on rent or mortgage payments actually works.

First, the big picture: Bilt does not charge a fee to earn points on rent or mortgage payments. That hasn’t changed. What has changed is that there are now two different, fee-free ways to earn points on housing — and which one makes sense depends on how much you actually use your card.

All Bilt cards follow the same housing-earning rules.

Option 1: Earn Points Automatically with Tiered Housing Rewards

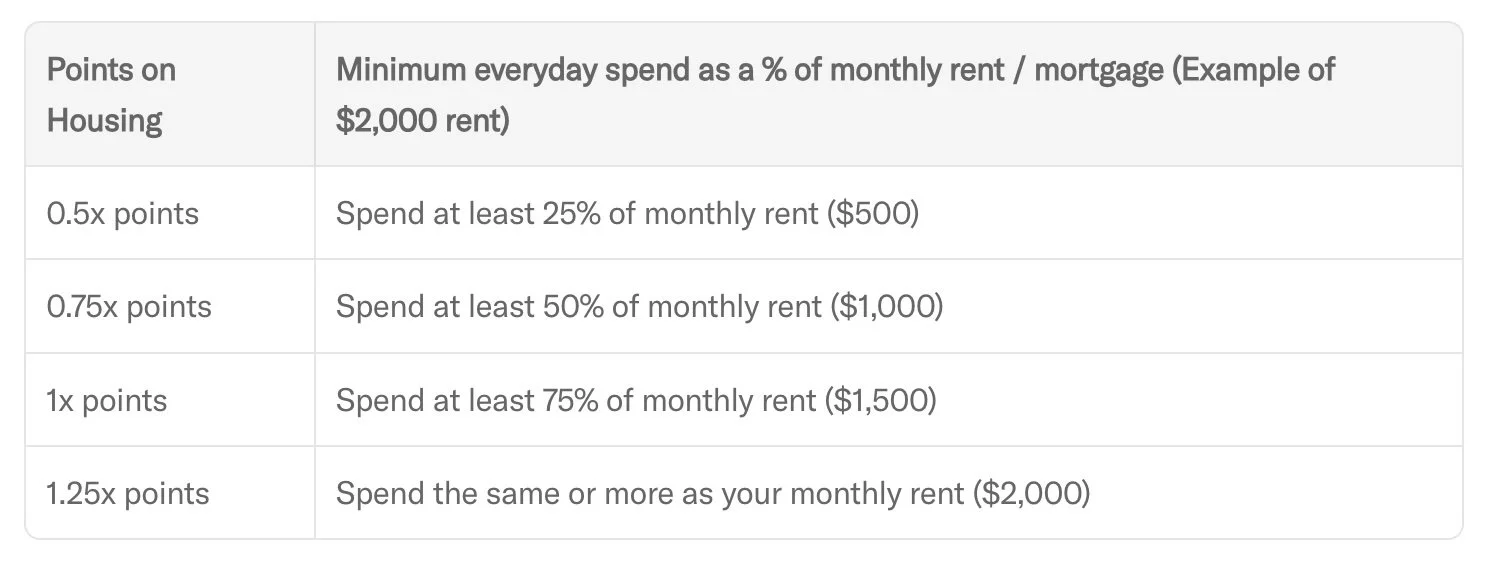

With Bilt Card 2.0, you can earn points on rent or mortgage payments automatically, based on how much everyday (non-housing) spend you put on your Bilt card each month.

Under this option, Bilt uses a tiered earning structure that awards between 0.5x and up to 1.25x points on your housing payment. The more you use your card for everyday purchases, the higher your housing earning rate — all with no transaction fee and no extra steps required.

If you don’t meet the minimum spending threshold in a given month, you’ll still earn a baseline 250 points per housing payment, which mirrors how the original Bilt card worked.

This option is the simplest path and works best for people who already put meaningful everyday spend on their card and want to earn points on housing without tracking any additional math.

Image via Bilt

Option 2: Use Bilt Cash to Unlock 1x Points on Housing

The second option uses Bilt Cash, which you earn from everyday spending on your Bilt card. You can then apply that Bilt Cash to unlock 1x points on your full rent or mortgage payment, again with no transaction fee.

A helpful rule of thumb:

$30 in Bilt Cash unlocks 1,000 points on $1,000 of rent or mortgage

That means you need roughly 3% of your housing payment in Bilt Cash to earn 1x points on the full amount

To generate that much Bilt Cash, most people would need to put about 75% of their rent or mortgage amount in non-housing spend on their Bilt card each month.

This option can be powerful — but it’s also the one that requires the most awareness of your actual spending.

So if you don’t have enough Bilt Cash to cover the whole payment, you can still earn points on a portion of it. If you are still confused, I got you! For a more detailed breakdown on how to earn Bilt points on Rent and Mortgage fee free, see this post: How to Earn Points on Rent and Mortgage

Use the Calculator: Does the Bilt Cash Method Make Sense for You?

The calculator helps you determine:

How much Bilt Cash you need to unlock points on your full rent or mortgage

How much monthly non-housing spend it takes to earn that Bilt Cash

Whether earning 1x points on housing is realistic for your specific situation

For some households, the math works great! For others, it quickly becomes clear that the tiered automatic earning option is the better fit.

If the calculator shows the Bilt Cash method isn’t realistic for your spending, that doesn’t mean a Bilt card isn’t worth it — it simply means Option 1 may be the better lower-effort path.

(Be sure to leave out commas if you want the calculator to work correctly)

Spend Needed to Earn 1 Point per Dollar on Housing

Assumes you need ~3% of your housing payment in Bilt Cash to earn points on the full amount, and you earn Bilt Cash at ~4% on everyday card purchases. Always confirm final terms with Bilt.

How to Choose the Right Bilt Card

Here’s the simplest way to decide:

If you want Bilt with no annual fee → Bilt Blue

If you spend a lot on dining/groceries + travel → Bilt Obsidian

If you want 2x on all non housing expenses and will use the hotel credits to help offset the annual fee → Bilt Palladium

| Feature | Bilt Blue | Bilt Obsidian | Bilt Palladium |

|---|---|---|---|

| Annual Fee | $0 | $95 | $495 |

| Welcome Offer | $100 Bilt Cash | $200 Bilt Cash |

50,000 Bilt points + $300 Bilt Cash + Gold elite status |

| Everyday Earn Rates | 1x points |

3x dining or groceries* 2x travel 1x other |

2x points |

| Bilt Cash on Everyday Spend | 4% Bilt Cash | 4% Bilt Cash | 4% Bilt Cash |

| Points on Rent & Mortgage | Up to 1x* | Up to 1x* | Up to 1x* |

| Travel Credits | — |

$100 hotel credit ($50 twice per year) |

$400 hotel credit ($200 twice per year) + $200 Bilt Cash annually |

| Other Perks | No foreign transaction fees | No foreign transaction fees |

Priority Pass lounge access No foreign transaction fees |

*Points on rent and mortgage payments depend on how much Bilt Cash you’ve earned from everyday spending. Use the calculator below to see how this works with your numbers.

The Bottom Line

Regardless if you decide to earn points on your mortgage, one of these cards may even be worth a spot in your wallet even if you decide NOT to earn points on your housing payment! Bilt points are VALUABLE. Bilt points transfer to strong airline and hotel partners — including World of Hyatt and Alaska Airlines Mileage Plan — so when used strategically, they can be worth a lot and a good strategy for nearly free travel!

Related Posts:

Bilt Card 2.0: How to Earn Points on Rent and Mortgage

FREE Beginner’s Guide to Points and Miles

Want to travel for free?! ✈️ Grab a FREE Beginner's Guide to Points and Miles and learn how to redeem FREE TRAVEL this year! CLICK HERE TO DOWNLOAD!

I appreciate it so much when you use my affiliate links that are linked in the post.

YOU MIGHT ALSO LIKE: